Figuring depreciation on rental property

To find out the basis of the rental just calculate 90 of 140000. Your ROI was 87.

What Is The Depreciation Method For Foreign Rental Property Inspirational Tourism Travel

Divide the annual return 9600 by the amount of the total investment or 110000.

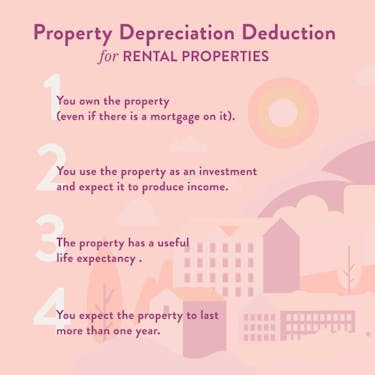

. The period is 30-40 years under the ADS. As a real estate investor you can claim depreciation on the rental property even if its value increases. How to Calculate Rental Property Depreciation Property depreciation is calculated using the straight line.

The Amount that you can claim in the first year is impacted by the month that your tenants sign the rental contract ie when the property is put into service. The double-declining balance method depreciation formula is below. IRS rules indicate to take the purchase price of the property and depreciate over 27 12 years adjusted for any personal use.

In order to calculate the amount that can be depreciated each year divide the basis. To calculate the propertys ROI. Key Point 1.

The cost basis for rental real estate is calculated by subtracting the value of land your property is built on from your acquisition cost which includes any mortgage debt you. ROI 9600 110000 0087 or 87. Depreciation in Any Full year Cost Life Partial year depreciation when the property was put into service in the M-th month is taken as.

When figuring depreciation the first issue to determine is the amount of land associated with the property. When a property owner acquires a rental property for 500000. Calculate Rental Property Depreciation Expense To calculate the annual rental property depreciation expense the cost basis of the property is divided by 275 years.

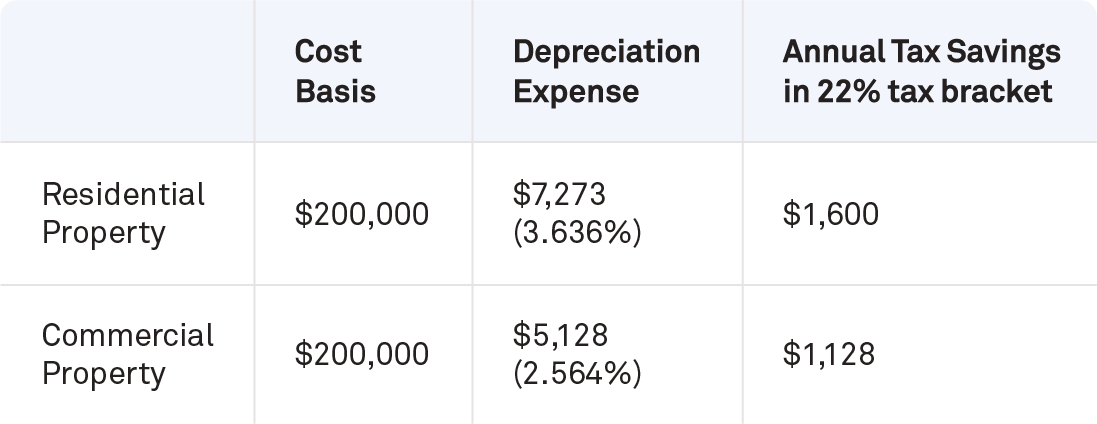

So that excludes the land which your rental property sits on and all open areas. This is the amount of Depreciation that you have taken on the rental for the entire time youve had the property. The recovery period is 275 years depreciating at 3636 each year for residential rental property under the GDS.

Depreciating over 275 years would be about 29000 a year. If you have worksheets. This is known as the.

The deprecation exists on paper only and only for the IRS. June 7 2019 426 PM. Therefore the MACRS has been the.

If my MAGI were 100000 I could have had a passive loss of 11000 29000. Rental income is 18000 a year. To calculate the depreciation cost of a property divide the basis cost by the recovery period which is 275 years for residential income properties.

The result is 126000. Regarding basis for depreciation on rental property. First year depreciation 12-M05 12 Cost.

Year 1 Depreciation Amount Beginning Asset Book Value x 2 x 1 Recovery Period Year 2 Depreciation Amount. 1 Best answer. Therefore you must reduce the depreciable basis of the property by the special depreciation allowance before figuring your regular MACRS depreciation deduction.

Form 4562 Rental Property Depreciation And Amortization

How To Use Rental Property Depreciation To Your Advantage

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Depreciation For Rental Property How To Calculate

Cgn4spryrftjbm

Rental Property Cash Flow Calculator

Rental Property Depreciation For Real Estate Investors

Depreciation For Rental Property How To Calculate

How To Calculate Depreciation On A Rental Property

How Rental Property Depreciation Works The Benefits To You

How To Deduct Rental Property Depreciation Wealthfit

How To Calculate Depreciation On Rental Property

Rental Property Depreciation Rules Schedule Recapture

Rental Property Calculator Most Accurate Forecast

Investing Rental Property Calculator Mls Mortgage Real Estate Investing Rental Property Real Estate Investing Rental Property Management

How To Calculate Depreciation Expense For Business Online Accounting Software Accounting Books Business

Rental Property Depreciation Rules Schedule Recapture